In Unity, There is Strength

On July 26, 1887, the Iowa Bankers Association became the fourth bankers association organized in the U.S. The following call was made for a convention of Iowa banks:

It being manifest by and through the general business of banks that imperfections exist in the usual system of some of the branches, and believing that a full, thorough and more uniform system should be adopted to facilitate the commercial interests of the state and country, and believing that an interchange of views of several bankers of the state will inure to the benefit of the bankers and stockholders as well as the business interests of the country, and realizing the fact that a state association is the only effectual medium through which the personal ideas and views of the representatives of the several banks of the state can be mutually and profitably exchanged.

Therefore, we, the undersigned bankers, for the purpose of effecting an organization to be known as the Iowa Bankers Association, would most respectfully call a convention of the bankers of Iowa, and those interested therein, to meet in the city of Des Moines, Iowa, on the 26th day of July, 1887, at which time all and any questions of moment in relation to said organization, and its motives, may be considered.

“Thus, it was 50 years after the first bank in Iowa, the Miners’ Bank of Dubuque, opened its doors to transact business on October 31, 1837, a small group of 29 Iowa bankers first realized that in their business, in unity there is strength.” — Howard Bell, University of Iowa Master of Arts Thesis, June 1950

Community Bank Solutions

The Iowa Bankers Association pioneered many services designed to enhance their members’ service to their community.

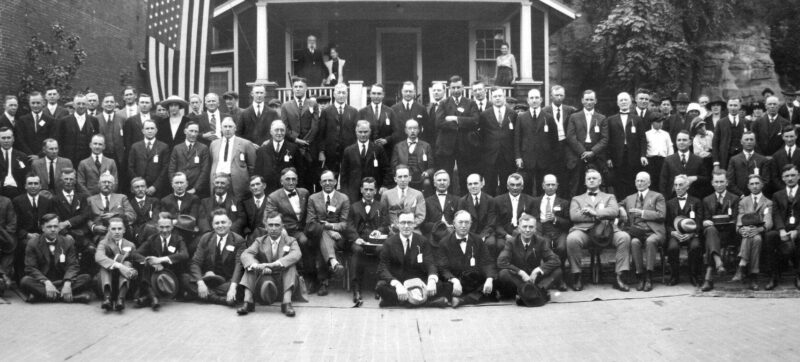

Vigilante movement

During the 1920s, when there were many bank robberies in Iowa, the IBA originated “Vigilante” committees in each of the state’s 99 counties, deputizing bankers and local citizens to aid law enforcement officials. The IBA offered a full line of ammunition and shotguns to its members. It also offered them training to (in the words of one report)“avoid shooting the customers.” In a five-year span, over 100 robbers were apprehended. It worked so well that Iowa insurance rates dropped to 20% of rates in surrounding states.

The IBA also organized the first statewide radio network— housed at the IBA offices in the Liberty Building — to alert the police whenever a robbery occurred. The network was subsequently taken over by the state police.

Iowa Bankers Insurance and Services, Inc.

Although the IBA has been in the bank insurance business since 1910, in 1971 they established a separate subsidiary — Iowa Bankers Insurance and Services, Inc. — to expand their offerings to Iowa banks. The agency has grown and added multiple product lines, providing health, life, annuity, and property and casualty insurance coverages. IBIS also administers a self-insured health plan for bankers in Iowa and Minnesota, called the Iowa Bankers Benefit Plan.

shazam

In 1975, the IBA helped establish the Iowa Transfer System, now known as SHAZAM, as one of the first electronic funds transfer (EFT) networks in the world. The early years of SHAZAM were ably navigated by CEO Dale Dooley. The network eventually became a state-authorized central routing unit for both ATM and POS debit transactions. Today, SHAZAM is a diversified payments provider serving financial institutions in nearly every state.

Iowa Bankers Mortgage Corporation

In 1979, the IBA created Iowa Bankers Mortgage Corporation to fund community bank mortgage loans, sell them into the secondary market and provide lifetime servicing for multiple investors. Today, IBMC services more than 60,000 loans. It is one of the largest mortgage loan aggregators in Iowa. IBMC President Dan Vessely was instrumental in its growth and development.

legal and regulatory compliance services

As the IBA entered the 21st century, it was apparent the sheer volume of banking laws and regulations required the association to expand its compliance services. At this time, the association began to supplement its regulatory counsel and training with bank pre-examination compliance reviews. This service has been of help to nearly every Iowa bank and has significantly enhanced the value of IBA membership.

“And so the history of the Iowa Bankers Association unfolds. The Association has been of service to banks and the public alike; it has remained strong and alert through depression and prosperity, war and peace. It is a flexible organization, adjusting itself to changing conditions, and adopting new methods of transacting its affairs when the need arises. The influence it has had on the growth and development of the state of Iowa can hardly be measured.” — Howard Bell, University of Iowa Master of Arts Thesis, June 1950